Explore the Modern Autonomous Revenue Systems for Insurance Brokerages & Agencies: The Future of Speed-to-Lead and Policy Growth

Discover how Autonomous Revenue Systems are revolutionizing insurance brokerages. Learn to leverage Generative AI, 24/7 Conversational Agents, and Nurture Automation to solve the “Speed to Lead” crisis and maximize policy volume.

Key Takeaways from Autonomous Revenue Systems for Insurance Brokerages

- Speed to Lead is Critical: In a hardened market, the first brokerage to quote often wins the business; manual follow-up is no longer competitive.

- 24/7 Availability: Autonomous Revenue Systems utilize AI to engage prospects, bind quotes, and service claims at any hour, independent of human staff schedules.

- Data-Driven Nurturing: AI moves beyond generic drip campaigns, dynamically shifting content strategy based on user engagement.

- Cost Efficiency: Automating revenue operations significantly lowers Customer Acquisition Cost (CAC) while increasing Customer Lifetime Value (CLV).

- Entity Salience: Successful implementation requires a clear understanding of technical entities like Large Language Models (LLMs), RPA, and API Integrations.

What is an Autonomous Revenue System?

An Autonomous Revenue System for insurance brokerages is an integrated technological ecosystem that leverages Artificial Intelligence, Machine Learning, and Robotic Process Automation (RPA) to execute marketing, sales, underwriting, and retention tasks without direct human intervention.

Unlike traditional CRM automation, which requires manual triggers, autonomous systems use predictive analytics to proactively identify leads, engage customers via Conversational AI, and finalize policy sales, ensuring revenue generation continues 24/7.

Introduction: The “Speed to Lead” Crisis in Insurance

The insurance landscape is undergoing a seismic shift. As noted in sector analyses, the industry is highly cyclical and sensitive to interest rates.

When rates drop and volume explodes, brokerages must capture leads instantly; conversely, when rates rise, the focus shifts to nurturing leads for months or years. However, a significant gap remains in how agencies handle these fluctuations.

Interest: The core pain point facing modern brokerages is “Speed to Lead”. In high-stakes environments like mortgage lending and insurance, the first entity to respond often wins the deal.

Yet, manual follow-up processes are far too slow for the modern digital consumer who demands instant gratification. If a potential policyholder requests a quote at 8:00 PM, waiting until 9:00 AM the next day often results in a lost sale.

Desire: Imagine a brokerage that operates independently of the clock. This is the AI Marketing Opportunity. By deploying 24/7 Conversational AI, agencies can qualify leads, answer complex coverage questions, and even schedule appointments with agents at 2 AM.

Furthermore, Nurture Automation allows for “drip” campaigns that automatically adjust content based on engagement—if a user lingers on high-value property pages, the system shifts strategies to match that intent.

Action: To survive and thrive in this digital-first era, brokerages must transition from manual dependencies to Autonomous Revenue Systems. This article outlines the roadmap to building an agency that sells while you sleep.

What are the trending topics in Insurance Automation?

Direct Answer: The current trending topics in insurance automation revolve around Generative AI for personalized policy crafting, Embedded Insurance capabilities, Predictive Analytics for churn prevention, and the integration of LLMs for real-time risk assessment.

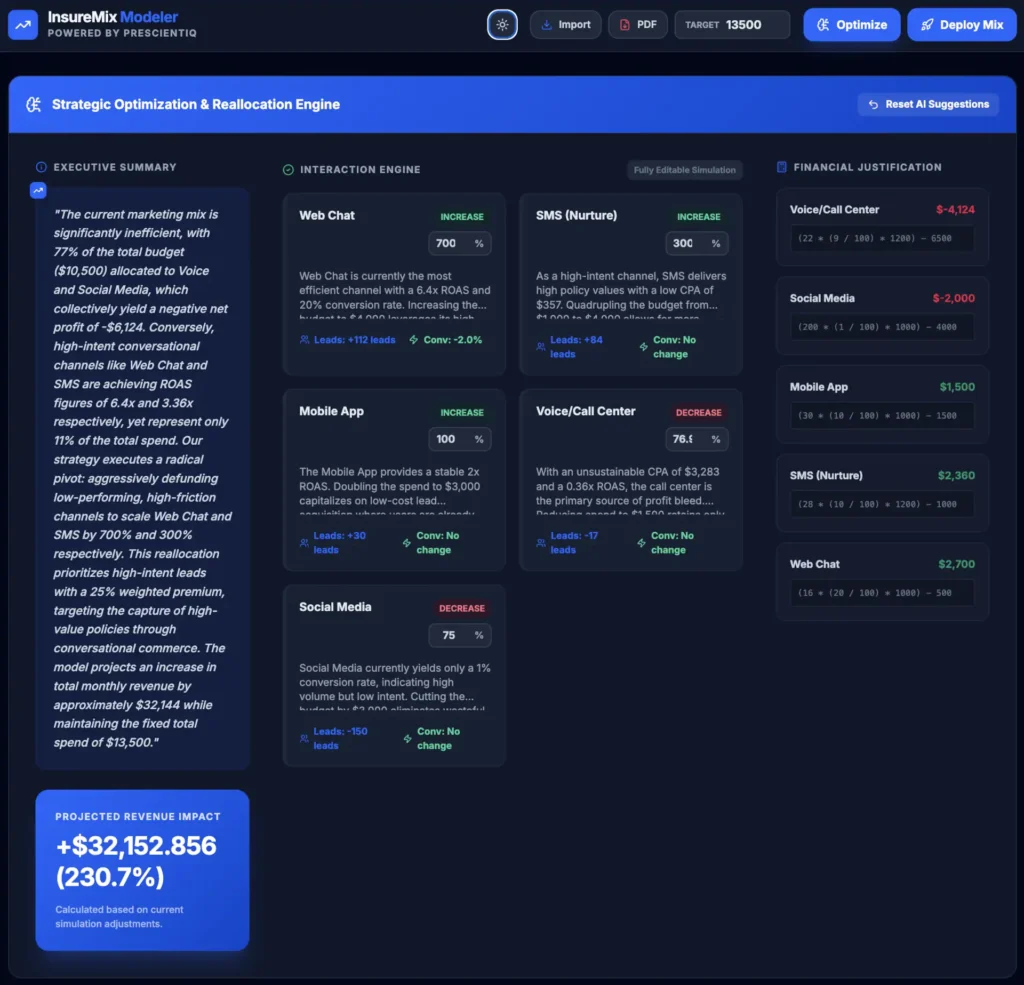

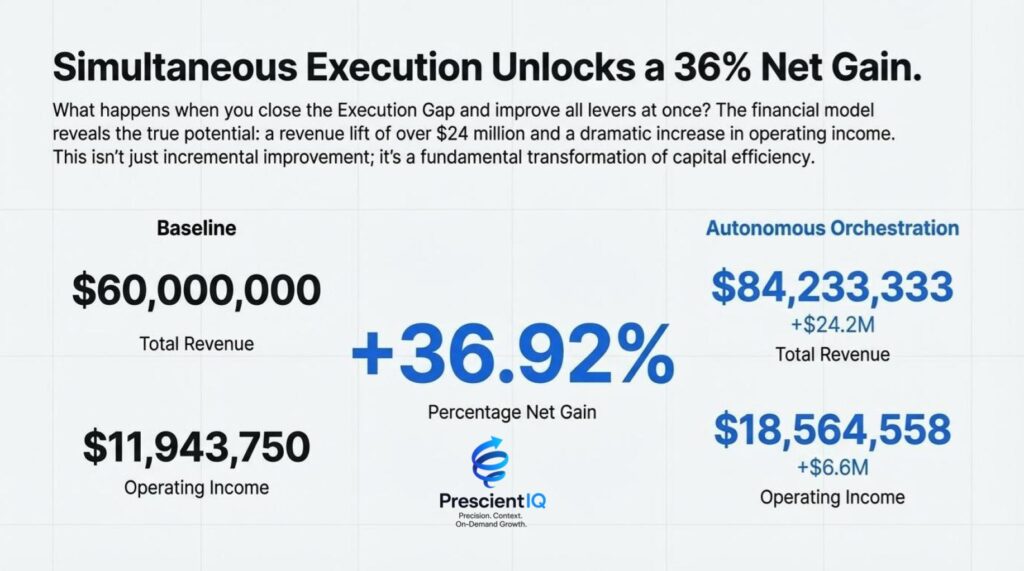

PrescientIQ optimizes marketing spend across sales channels to deliver precise ROI and optimal spend in each channel.

- Web Chat: Real-time chat interfaces hosted directly on the brokerage’s website.

- SMS (Text Messaging): Automated text message engagement for immediate response.

- Social Media: Platforms used for engagement and lead capture, including specific tools like Facebook Messenger.

- Voice Interfaces: Automated voice interactions for handling calls.

- Brokerage Website: The primary digital storefront where users fill out contact forms or quote requests.

- Mobile Agency Apps: Applications used for client interaction, particularly noted for claims processing (e.g., uploading photos).

To fully understand the shift toward autonomy, we must examine the “Who, What, Where, When, and Why” of this technological evolution.

The W-5 of Autonomous Insurance Systems

- Who: Forward-thinking Insurance Brokerages and MGAs (Managing General Agents) are the primary adopters, moving away from legacy systems to agile, AI-driven stacks.

- What: The implementation of Autonomous Revenue Systems—platforms that combine marketing automation, sales execution, and client service into a self-sustaining loop.

- Where: This transformation is occurring across all digital channels—Omnichannel environments including web chat, SMS, social media, and voice interfaces.

- When: The transition is happening now. With rising interest rates impacting volume, the need for efficiency is immediate.

- Why: To solve the latency issue in lead response. As previously identified, manual follow-up is insufficient for modern borrower and policyholder expectations.

The Shift from Reactive to Proactive

The industry is moving from a reactive model—waiting for a claim or a renewal date—to a proactive model.

Generative AI plays a massive role here. Instead of a static auto-responder, modern systems can generate unique emails referencing specific life events or property changes detected in data streams.

This level of Information Gain is critical for ranking well in search engines and for building customer trust.

What do top research firms say about AI in Insurance?

Direct Answer: Leading research firms consistently report that AI in insurance is shifting from an experimental luxury to a fundamental operational necessity, with a heavy emphasis on hyper-personalization and operational efficiency.

According to Deloitte reports, the insurance sector is undergoing a transition in which the boundaries between marketing, sales, and service are blurring. They suggest that Generative AI is not just a tool for content creation but a mechanism for redefining the entire value chain.

McKinsey & Company has frequently highlighted the economic impact of automation. Their research indicates that existing technologies can automate a significant portion of current work activities.

In the context of insurance, this means that tasks such as data entry, initial risk assessment, and standard communication can be handled entirely by Autonomous Agents, freeing up human brokers to handle high-complexity relationships.

Furthermore, Gartner emphasizes the importance of Hyperautomation. This involves the orchestrated use of multiple technologies, tools, and platforms—including AI, Machine Learning, and RPA—to rapidly identify, vet, and automate as many business and IT processes as possible. For an insurance agency, this translates to a system where a lead entering the funnel triggers a cascade of automated actions: credit checks, risk profiling, quote generation, and compliance verification.

Key Industry Statistics

- Adoption Rates: Data suggests that over 70% of insurance executives plan to increase investment in AI-driven technologies to improve the customer experience.

- Efficiency Gains: Firms deploying Conversational AI often see reductions in customer service costs of up to 30%.

- Speed to Lead: Research indicates that responding to a lead within the first minute increases conversion rates by nearly 400% compared to responding after an hour.

- Consumer Preference: Approximately 60% of consumers prefer digital channels for simple transactions, such as bill payments or checking policy status.

- Data Utilization: Insurers that use advanced analytics and AI are 23 times more likely to acquire customers than those that do not leverage these insights.

How does an Autonomous Revenue System for Insurance Brokerages function in real-world scenarios?

Direct Answer: Autonomous systems function by creating a seamless bridge between data ingestion and actionable outcomes, utilizing Natural Language Processing (NLP) to understand intent and RPA to execute tasks across three primary vectors: Sales, Renewals, and Claims.

Use Case 1: The Midnight Lead (New Business)

- Before: A potential customer searches for “term life insurance” at 11:30 PM. They fill out a contact form on a brokerage website. The form sits in an inbox until 9:00 AM the next day. By the time the agent calls, the customer has already purchased a policy from a competitor who offered an instant online quote.

- After: The customer fills out the form at 11:30 PM. Immediately, an AI Agent engages them via a chat interface or SMS. The AI asks qualifying health questions, accesses databases to verify information, generates a binding quote, and processes the payment—all within 15 minutes.

- Bridge: 24/7 Conversational AI. By deploying chatbots that can qualify leads and answer complex rate questions at any hour, the brokerage captures the “Speed to Lead” advantage, turning a cold lead into immediate revenue.

- +1

Use Case 2: The Silent Churn (Renewals)

- An auto insurance policyholder’s rate increases by 15% due to inflation. They receive a standard renewal notice in the mail. Frustrated and feeling undervalued, they shop around and cancel their policy without speaking to their agent. The agent only realizes the loss after the cancellation is processed.

- Three months before renewal, the Autonomous System detects a likely rate increase. It automatically scans the market for competitive options and sends a personalized video message to the client explaining the market conditions and offering three alternative plans (including staying put with added value).

- This is Nurture Automation. The system adjusts content based on the user’s engagement and external data factors. By anticipating the pain point (a price increase) and proactively offering solutions, the system retains revenue that would have otherwise churned.

Use Case 3: The Fender Bender (Claims Experience)

- A client is involved in a minor accident. They call the agency, leave a voicemail, wait for a callback, fill out paper forms, and wait weeks for an adjuster. The friction damages the client relationship.

- The client opens the agency app and uploads photos of the damage. Computer Vision AI analyzes the images, estimates the repair cost, cross-references the policy deductible, and instantly approves a payout to the client’s bank account for the repair amount.

- The bridge here is Visual Intelligence combined with Smart Contracts. The autonomous system handles the entire “First Notice of Loss” (FNOL) process, turning a negative event into a demonstration of efficiency and reliability.

Comparison: Traditional vs. Autonomous Brokerage

The fundamental difference lies in reliance on human latency; traditional brokerages are limited by human working hours and cognitive load, while autonomous brokerages operate at infinite scale and with instant execution.

| Feature | Traditional Brokerage | Autonomous Revenue System |

| Availability | 9 AM – 5 PM (Mon-Fri) | 24/7/365 Operations |

| Lead Response | Hours or Days (High Latency) | Instant (< 1 Minute) |

| Personalization | Generic Templates | Hyper-personalized via Generative AI |

| Scalability | Linear (Requires hiring more staff) | Exponential (Software scaling) |

| Data Usage | Historical / Reactive | Predictive / Proactive |

| Customer Journey | Fragmented touchpoints | Seamless Omnichannel flow |

What challenges do brokerages face when implementing AI?

Direct Answer: The primary challenges include Data Privacy concerns, the integration of Legacy Systems, and the Talent Gap required to manage complex AI architectures.

Implementing Autonomous Revenue Systems is not without its hurdles. To ensure Entity Salience and clarity, we must break down these barriers.

Challenge 1: The Legacy Tech Debt

Most established insurance agencies rely on Agency Management Systems (AMS) that were built decades ago.

These systems often lack open APIs (Application Programming Interfaces), making it difficult for modern AI tools to “read” and “write” data into the core record.

This creates data silos where the AI might generate a lead, but the AMS doesn’t effectively record it.

Challenge 2: Regulatory Compliance and Ethics

Insurance is a heavily regulated industry.

When using Generative AI to give advice or explain policy details, there is a risk of “hallucination,” where the AI provides incorrect coverage information.

Ensuring that AI Agents are compliant with state insurance laws and do not engage in discriminatory pricing practices is a major implementation challenge.

Challenge 3: The “Human in the Loop” Balance

While the goal is autonomy, completely removing humans can alienate certain demographics. Finding the right balance—knowing when to escalate a chat from a bot to a human agent—is critical.

Over-automation can lead to frustration if the AI cannot handle a complex, emotional claim situation effectively. But human-on-the-loop excels in hyper-personalization in one-to-one relationships.

How to Implement an Autonomous Revenue System: A Step-by-Step Guide

Direct Answer: Implementation requires a phased approach: auditing current data, selecting a “Speed to Lead” tech stack, automating the nurture sequence, and finally, integrating predictive analytics for renewal management.

Follow these steps to transition your agency:

Step 1: Data Unification and Audit

Before AI can work, it needs clean data. Consolidate your customer lists, policy details, and interaction logs into a centralized Customer Data Platform (CDP).

Ensure that your data is structured so that Machine Learning models can identify patterns.

Step 2: Deploy the “Speed to Lead” Layer

Implement a Conversational AI chatbot on your website and social channels. Configure it to handle:

- Initial lead qualification.

- Basic FAQ resolution.

- Appointment scheduling.

- Reference: As noted, this solves the manual follow-up delay.

Step 3: Build Dynamic Nurture Campaigns

Move away from static newsletters. Use marketing automation platforms that support conditional logic.

- Trigger: Client views “Cyber Insurance” page.

- Action: Send a case study on cyber risks for their specific industry.

- Refinement: If they click, notify a specialist agent; if not, send a lower-stakes educational video.

- Reference: This aligns with the strategy of adjusting content based on engagement.

Step 4: Integrate Predictive Renewal Models

Feed your historical retention data into an AI tool to score current clients on their “likelihood to churn.” Set up automated workflows that trigger retention offers to high-risk clients 90 days before expiration.

Conclusion on Autonomous Revenue Systems for Insurance Brokerages

The transition to Autonomous Revenue Systems for Insurance Brokerages is not merely a technological upgrade; it is a fundamental survival strategy in a volatile economic environment.

As rates fluctuate and the “Speed to Lead” becomes the primary differentiator, agencies that cling to manual processes will lose market share to those that embrace automation.

By deploying 24/7 Conversational AI and sophisticated Nurture Automation, brokerages can lower their costs, increase policy volume, and provide the instant, high-quality service that modern consumers demand.

The future of insurance is not just about coverage; it is about the speed and intelligence with which that coverage is delivered.

Next Steps for Your Agency:

- Audit your response times: Measure exactly how long it takes your team to respond to a web lead.

- Pilot a Chatbot: Choose one channel (e.g., website or Facebook Messenger) and deploy a simple AI agent to handle after-hours queries.

- Clean your Data: Begin standardizing your CRM data to prepare for AI integration.

FAQ about Autonomous Revenue Systems for Insurance Brokerages

What is an autonomous insurance brokerage?

An autonomous insurance brokerage utilizes Artificial Intelligence and automation to handle core business functions—such as lead generation, quoting, binding, and claims processing—with minimal human intervention, operating 24/7 to maximize revenue and efficiency.

How does AI improve “Speed to Lead” in insurance?

AI improves “Speed to Lead” by instantly engaging prospects the moment they inquire, regardless of the time. Automated agents can qualify leads and schedule appointments immediately, preventing potential clients from moving to competitors

Can AI replace human insurance agents?

AI is designed to augment, not replace, human agents. It handles repetitive tasks, data entry, and initial inquiries, allowing human agents to focus on complex advisory roles, relationship building, and high-value commercial accounts.

What are the risks of using AI in insurance sales?

Key risks include data privacy breaches, algorithmic bias in pricing or underwriting, and regulatory non-compliance. Agencies must ensure their AI tools are transparent, secure, and monitored to adhere to strict industry regulations.

How does nurture automation work in insurance?

Nurture automation uses data to track user behavior and automatically delivers relevant content. For example, if a client reads about flood insurance, the system automatically sends detailed flood coverage information, increasing the likelihood of an upsell.